Opensea

Opensea is known to everyone within the NFT world and is considered the platform par excellence for the most popular projects and the most prominent creators.

Let’s look at its main features.

First of all, it is an NFT marketplace, the first and the largest in the world, comparable to a Blockchain Ebay. Within Opensea you can be a creator or collector, create collections and participate in unique projects.

All you need to access your Opensea account is an Ethereum address and you will already be able to see NFTs within your profile, with the ability to put them up for sale or send them to other wallets.

Prior to Opensea, it was not possible to do this kind of transaction, in fact it has always been a benchmark for buying and selling NFTs since its founding in 2017, especially for projects dedicated to collectibles (CryptoPunks) and gaming (CryptoKitties, Axie Infinity).

The peculiarity of Opensea for the world of creators is the possibility of free minting and the presence of fixed fees at 2.5% on each sale. In fact, comparing these fees to Ebay (10%) or other marketplaces such as Foundation (5%), we are talking about a really low percentage.

It is also possible to use different cryptos as payment methods, in particular ETH and WETH: the former dedicated to NFTs created on the Ethereum blockchain, the latter for NFTs created with the support of the Polygon MATIC network.

In terms of content, Opensea has all possible NFTs within it: gaming, collectibles, lands, art, tickets, etc. Because of this, the visibility within the site is not the best for artists, overshadowed by the pfp (“Photo For Profile”) collections that are most in vogue at the moment.

With the latest update in April 2022, the ability to create NFTs on the Solana Blockchain was introduced.

Foundation App

Foundation.app is founded in 2020 by Kayvon Tehranian, a Princeton graduate entrepreneur, and subsequently launched in early February 2021 with the purpose of creating a “community-curated” NFT marketplace, where artists have the opportunity to invite other creators after each sale, so as to expand the marketplace while maintaining high quality of works. Foundation became popular during March and April 2021 thanks to several artists who chose the platform to sell their works. Among them, we can mention Edward Snowden and the Nyan Cat, both of which sold for millions of dollars.

Creators can create NFTs of 3 different types: photos, videos, and 3D. Most of the earnings come from primary market sales, that is, from the first sale of each NFT. Then the creator earns 10% artist’s royalties for each sale on the secondary market, that is, each resale of that particular NFT.

In addition to regular sales, it is possible to create NFTs in collaboration with other artists, so that the sale earnings and royalties are “split” automatically.

The platform earns money through fees: in fact, with each sale, prior to the March 2022 update, the earnings were 15% of the final sale price of each NFT. After several complaints during the first year after launch, with the March update the platform lowered the fee to 5 percent in order to incentivize artists to mine their works within the platform.

Unlike marketplaces such as Opensea or Rarible, Foundation needs the creator to pay Ethereum gas fees at both minting and listing, and this results in exorbitant figures in excess of $300 in ether countervalue often being reached. For this reason, the minimum price for an NFT on the platform is around 0.1 ETH.

A recent update also introduced the possibility of creating personal collections, detached from the large Foundation collection (where all the pieces mint within the platform used to go), in order to ‘decentralize’ the platform more to make artists even more autonomous.

Foundation certainly is one of the most prominent platforms is used by artists. Despite having invitation-only entry, the platform has populated drastically in recent months, leading as a side effect to a considerable decrease in the level of visibility of smaller artists.

With the latest update in April 2022, Foundation drastically revamped the marketplace, removing the invitation-only mode and thus opening the platform to everyone.

SuperRare

Founded in 2017 and later officially launched in 2018, SuperRare is considered the holy grail of marketplaces, the top of the top of a career in cryptoArt. The sales system remains similar to the platforms seen previously: it is possible to list works with a reserve price and then trigger a 24-hour auction or with a buy now where the collector buys the work directly at the price specified by the artist. The peculiarity of this marketplace, however, is its exclusivity. In fact, in order to be able to sell one’s work, it is necessary to send an application directly to the platform (complete with video presentation, portfolio, etc.) and wait for a positive outcome of the request. This system makes it possible to limit the entry of new artists to a “select few,” who will have the opportunity to put their work up for sale on the most curated platform in the industry. Regarding fees, the system is similar to Foundation: on the first sale the fees are 15% to be subtracted from the sale price, thereafter in secondary sales the artist’s royalties are 10% with an additional 3% going to the platform.

In 2021 the platform announced the native $RARE token with a supply of 1,000,000,000 of which 15% distributed via airdrop to artists and collectors on the platform.

With the release of this token, the platform announced that fees from each sale, which in the previous 2 years went to the platform, will now instead be dedicated to Community Treasury controlled by the SuperRare DAO.

The SuperRare DAO is a smart contract launched on the Ethereum network (superraredao.eth). The token holders collectively control the DAO, there is in fact a 7-person council consisting of the community leaders, investors and founders that coordinates the organization in order to decide how to develop the future of the platform.

Known Origin

Considered a niche marketplace, in recent months it has begun to be a big competitor to more popular platforms. The platform is curated, as is SuperRare, but it does not accept new artists all the time; rather, they create a kind of wave entry, where for limited periods of time you can apply and, if you are lucky, be accepted. Unlike SuperRare, not only big-name artists who have already launched are accepted, but the platform also seeks out smaller, lesser-known but equally good artists.

A novelty compared to other curated marketplaces is the ability to create multi-edition NFTs, an option available only in larger and more accessible marketplaces such as Opensea or Rarible.

Nifty Gateway

Nifty Gateway is a marketplace where the platform itself controls individual sales, minting, and other activities. In fact, what the platform wants to do is to create a marketplace as a kind of auction house: it organizes drops of artists linked to the platform every 3 weeks in order to boost sales and not leave any artist left to his or her own devices.

Nifty Gateway has had drops by very famous artists including Steve Aoki, Beeple, Grimes, and Deadmaus.

Another peculiarity of this marketplace is theabsence of gas fees: being curated drops the platform takes care of the minting and listing fees.

The platform, being centralized, is custodial. This means that the platform’s NFTs are held on a secure wallet created in this case with Gemini’s technology.

Being a platform created in collaboration with the Winklevoss brothers’ Gemini exchange, payment methods vary from common ether payments, to direct credit/debit card payments or by linking your Gemini account you can use the funds within it and pay internally.

Rarible

One of the most socially inclined marketplaces. In fact, with Rarible you can follow and like your favorite artists and NFTs, creating a kind of social media for NFTs. Open to everyone, like Opensea, it allows the creation of NFTs on different Blockchains: Ethereum, Tezos, Polygon and Flow.

You can create 1/1 or multi-issue NFTs, collectibles, and even see gaming-related NFTs.

The platform also has its own dedicated coin, RARI, which allows people to participate in governance to vote on future changes and updates to the platform.

Makersplace

Very similar to Know Origin, it has the only exception that there are 15 percent fees for each sale, both primary and secondary. Considered open to all types of artists, it allows for an easy-to-use marketplace compared to others such as Opensea.

LooksRare

LooksRare started as a competitor to Opensea, but unlike the latter, it has an advantage for those who use it: it is indeed possible to earn $LOOKS by listing and selling NFTs on their platform. In addition, it is possible to staking this token directly on the platform.

Payments received as a result of a sale are in WETH, meaning that they are then delivered as tokens from the Polygon network.

Art Blocks

Last but not least, Art Blocks. Marketplace of excellence for the generative crypto art market. It allows the creation of potentially endless collections tied to the generative codes of an AI or simply a random program. Collectors get to actively participate in the creation of artwork, as a collector on Art Blocks has the ability to mine a new collection piece without knowing how it will come out.

All the collector has to do is choose the type of artwork he or she wants to mine based on the generative code for it, creating upon minting a random version of this code that is different from any other version previously mined. The result can be a simple static image, a 3D model, or an interactive experience. The platform is curated to prevent the arrival of poor quality projects, so entry is allowed following a positive approval of the application form. Platform fees stop at a mere 10 percent with each purchase.

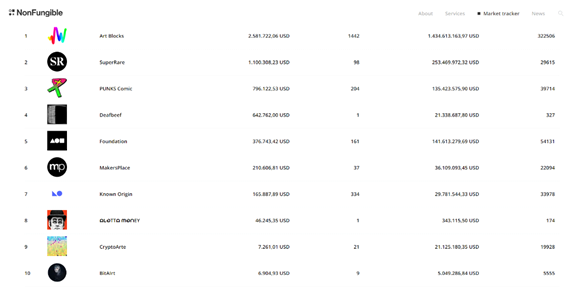

Data comparison

We refer to nonfungible.com for a more detailed comparison regarding the number of sales and volume traded within the various marketplaces.

Again thanks to the same site we report the data in the figure below, from which it can be seen that SuperRare leads in total Ethereum volume but in terms of the number of actual sales, Foundation has more than twice as many with half the volume. This means that there are more sales but at lower prices.

Known Origin, on the other hand, is the marketplace with the largest increase in the number of sales, surpassing SuperRare and coming close to Foundation.

First in the ranking, on the other hand, we find Art Blocks thanks to sales of hundreds of thousands of dollars of the most famous generative art collections that have also attracted great interest from “swappers” i.e., those who buy and resell artwork in a short time to speculate.