History

Tezos is founded by a couple, Arthur and Kathleen Breitman, who have been active in the crypto world since the birth of Bitcoin. The couple met at a crypto-anarchist dinner in 2010 and later married in 2013. Their idea arose from the different view of thinking found in the crypto world during the birth of the first altcoins. Many “bitcoiners” believed that Bitcoin would incorporate the best features of these new coins, while others maintained a more conservative view of Bitcoin, seeing it as a perfect ecosystem as it was created. Going back to the pair, in 2014 they founded Tezos with the idea of creating a blockchain that could easily evolve and adapt to new technologies through a decentralized governance system, thus going against the view that people had of the “ideal model” of cryptocurrency in those years.

In 2015, the pair founded Dynamic Ledger Solutions to develop the blockchain and its ecosystem, later hiring a French software company called O’ Camel Pro to help them with the creation.

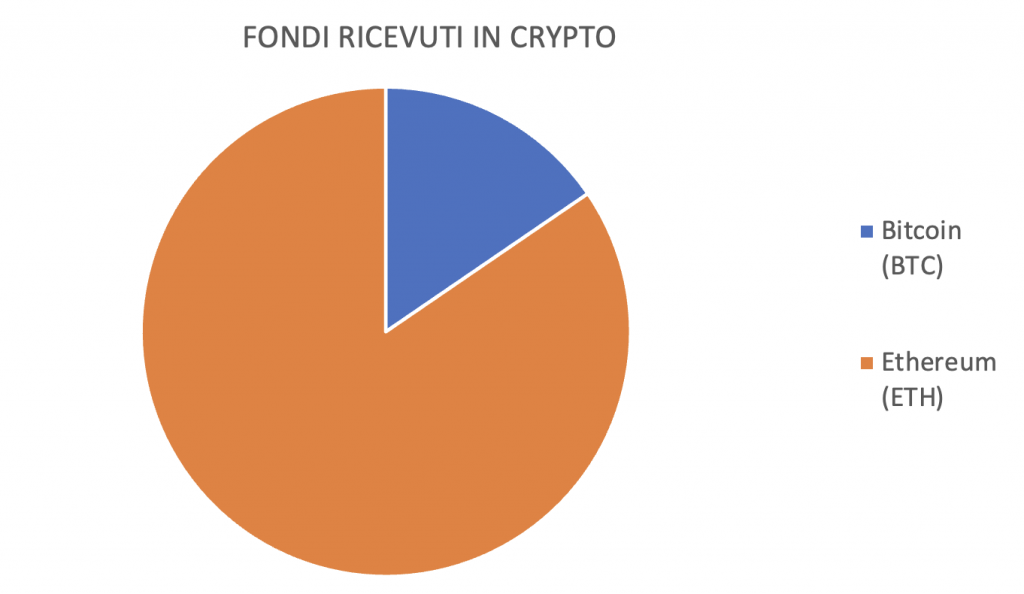

A few years later the Tezos Foundation was founded in Switzerland, raising through an ICO as much as $232 million in BTC and ETH in July 2017.

In the years since the ICO, the Tezos Foundation has had a variety of problems.

After the ICO, the blockchain was behind schedule and had to postpone the launch of the mainnet until September 2018, creating general discontent among early ICO investors and causing the firing of the then CEO of the Tezos Foundation and the replacement of the foundation’s internal board. Subsequently, several lawsuits by early ICO investors also arose, which lasted for over 3 years until September 2020.

How it works

The foundation of the Tezos blockchain is based on a Proof-of-Stake model.

This model is driven by governance controlled by validators, called in the Tezos ecosystem “Bakers.”

Bakers are nothing more than vote-holders within the ecosystem. To become a Baker, one must block a Tezos roll, equivalent to 8000 XTZ (cryptocurrency native to the Tezos blockchain). If you do not have this amount of XTZ within your wallet, you can still “delegate” your tezos, via a staking system, to a validator at our discretion, allowing participation in governance. Thanks to this delegation system, the consensus mechanism can also be called LPoS, Liquid Proof-of-Stake, which mind you, is not very far from the DPoS (Delegated Proof-of-Stake) model, but it has a peculiarity that differentiates it from the latter: token holders can change the delegator at any time and can therefore be more active and participatory in the community, compared to delegated proof-of-stake that does not allow these sudden changes.

Tezos has its own native language for smart contracts, called Michelson. It facilitates formal code verification through mathematical properties of a program such as a smart contract allowing for greater security and extremely reducing bugs within the code. This little-known language, however, is considered a problem by members of the Tezos Foundation because, being niche, few developers are able to create dapps and DeFi ecosystems. For this reason, the foundation is involved in creating courses and guides to help developers create dapps in the Tezos ecosystem.

Team

The peculiarity of Cardano is probably its development team. It consists of 3 different independent teams, each with a leader, who control various aspects of the project:

- IOHK: “InputOutput Hong Kong,” founded by Charles Hoskinson and Jeremy Wood with the task of creating blockchain in a decentralized way. The particularity of this company in fact is that it consists of small teams of researchers, educators and academic partners scattered all over the world, self-sufficient and able to decide together on Cardano developments. IOHK in particular is dedicated to promoting research and academic studies related to the cryptographic and blockchain world;

- Cardano Foundation: legal custodian of the Cardano protocol and brand, the foundation is concerned with expanding blockchain adoption and partnerships. It is also a kind of council that decides together with the community what is best for Cardano;

- Emurgo: develops, supports and creates business opportunities and facilitates the integration of them within the blockchain. It has offices scattered around the world (Japan, USA, Singapore, India, Indonesia) creating a kind of network of blockchain experts and developers.

Mainnet updates (May 2019-April 2022)

Tezos in the course of its existence has already achieved excellent results in its self-evolution path, successfully achieving as many as 8 updates, let’s see them individually:

- Athens: approved in May 2019, decreased the minimum XTZ to become Bakers from 10,000 to 8,000 and increased the limit of gas fees;

- Babylon: approved during October 2019, facilitated the creation of dapps and improved governance efficiency;

- Carthage: approved during March 2020, increased the gas fees limit again and improved the development of protocols in the ecosystem;

- Delphi: approved during November 2020, adjusted gas fees parameters and reduced blockchain storage cost;

- Edo: approved during February 2021, added the ability to create private smart contracts. It also reduced the duration of governance phases and introduced a fifth phase, Adoption;

- Florence: approved during May 2021, doubled the maximum size of smart contracts, optimized gas fees, added the ability to create more intuitive smart contracts, and disabled the activation of the testnet in the Testing phase since in previous updates it was never used with a pure testing purpose, creating problems for node operators upon its activation;

- Granada: approved during August 2021, introduced Liquidity Baking, which mines a small amount of tez with each block created and deposits this amount within a liquidity pool of tez and wrapped BTC of the Tezos network (tzBTC) so as to incentivize the use of the network;

- Hangzhou: approved during December 2021, brought several improvements including the ability to give smart contracts the ability to Views, that is, view the storage status of other smart contracts allowing for greater transparency in this regard. Also introduced was Timelock, an encryption that makes it possible for smart contract authors to include strong countermeasures against MEVs, also called Block Producer Extractable Value, the tez values that are mined when new blocks are created, allowing faster access with a lower gas cost to data that is accessed frequently;

- Ithaca: approved in April 2022, introduced Tenderbake, a significant upgrade to the Tezos consensus algorithm that enables faster finalization and higher blockchain scalability. The minimum number of tezos to be a validator was also reduced again (from 8000 to 6000).

Decentralization

According to a report done by the firm PwC regarding the environmental impact of Tezos blockchain, there were 445 active Bakers in 2020, while in 2021 there were 411, keeping a very high percentage of them in the United States.

In fact, the States are first in the ranking with an impressive 27.19% of total Bakers, while in second place we find Germany with an equally high percentage, 19.10%.

Next we find France with 9.21%, Finland with 6.07%, Ireland with 5.84%, and so on

Environmental impact

Tezos boasts of being one of the greenest blockchains in the crypto sector, providing data regarding energy consumption that is truly impressive.

This data was studied and examined by the firm PwC, which provided a detailed account of the blockchain’s environmental impact focusing on 3 main and fundamental aspects of Tezos:

- Keeping a node like Baker active;

- Creating a transaction;

- Consuming one unit of gas for a smart contract.

According to this research, Tezos consumes about 2.4E-4 g of CO2 per unit of gas in smart contracts, about 2.5g of CO2 per transaction, and an annual total of about 161 kg of CO2 to keep a node active.

Bearing in mind that the number of transactions increased by 836% from 2020 to 2021 (from 6,066,719 to 56,776,617), it can be calculated that the annual energy consumption of the entire blockchain is about 0.001 TWh. Thanks to its on-chain governance that can make the blockchain increasingly efficient, Tezos has managed to decrease energy consumption per transaction by about 70 percent through the Granada upgrade focused on reducing fees, with consumption per transaction reduced in 2021 to about 30 percent of what was needed in 2020.

Ethereum, the rival blockchain, uses about 175.56 kWh for a single transaction, while Tezos consumes 0.0016 kWh. Comparing the annual data offered by Digiconomist.net we can also learn that Ethereum uses about 112 TWh per year, an exorbitant number compared to Tezos’ 0.001 TWh.

It must be kept in mind, however, that Ethereum is still based on Proof-of-Work technology, thus maintaining a necessarily higher energy consumption than a Proof-of-Stake blockchain. Following the Merge, Ethereum aims to reduce this number dramatically, expecting a result close to 0.01 TWh per year.

Governance

Tezos, to continue its evolution, uses an on-chain process to propose, select, test, and activate update protocols without the use of hard forks.

Thus, for each blockchain update there are 5 governance-driven steps:

- Proposal: Bakers can propose up to 20 upgrade ideas. When a Baker proposes an idea, they automatically vote for that idea based on the number of Rolls they own. Bakers can subsequently vote once for up to 20 different proposals. Tezos likens this voting method to a kind of upvote. At the end of the Proposal period, all proposals that have reached at least 5 percent of the total number of votes are selected. Should no proposal reach this percentage, the Proposal period begins again;

- Exploration: in this period the Bakers are in charge of choosing the best idea from those chosen in the Proposal period. For each proposal, the Bakers must cast a “yay,” “nay,” or “pass” vote at their discretion. A staker who has delegated his tezos to a Baker can even change Bakers, choosing one with his own preferences. At the end of this period, the proposal that has reached at least 80 percent of the total votes wins. If no proposal reaches a majority, the process starts over from scratch going back to the beginning of the Proposal period;

- Testing: A testnet is created that will run in parallel with the mainnet for 48 hours. This period is useful for understanding the operation of the proposal within a “demo” mainnet. At the end of this period there is no voting, but it goes directly to the next period;

- Promotion: In this period, it is decided whether to adopt the update or not based on off-chain discussions and testnet behavior. As in the Exploration period, the Bakers decide whether to vote yes or no. Should the vote reach 80% yes, then it moves to the last phase, otherwise it goes back to the Proposal period;

- Adoption: Once the Promotion period vote is successfully completed and approval is achieved, the proposal is activated as a new mainnet. Next there is a “cool-down” period that allows developers and Bakers some time to adapt, if necessary, their dapps and code to the new update. Finally, a new Proposal period begins.

XTZ Tokenomics

XTZ is the native coin of the Tezos blockchain and is required to vote on protocol updates that have been developed and proposed by the team, to staking and pay fees to make transactions, and to execute smart contracts.

The maximum coin offering is infinite in the sense that there is no set number of coins that can exist in the life of Tezos; the total offering stands at approximately 922 million XTZ; the circulating offering, as of the date of writing, comes to 900 million XTZ.

The Initial Coin Offerings

Although the project had been developed since 2014, Tezos’ ICO took place from July 1 to 15, 2017, and $232,000,000 was raised, divided into 66,000 bitcoins and 361,000 ethers, thus enjoying considerable success given the high amount.

Staking and inflation

Tezos is based on the Proof of Stake consensus algorithm, and the XTZs staked cannot be used for other assets, as they generate interest that averages 6%. The current supply inflation of XTZ is 4.87% and approximately 38% of the supply is placed in staking, so the staking ratio is mediocre.

NFT, DeFi and Metaverse

Within the Cardano ecosystem there are already a number of projects concerning the DeFi and NFT worlds, as well as several metaverses under development.

First NFT marketplace of all is probably CNFT.io, Cardano’s Opensea, which has already recorded sales in the hundreds of thousands of dollars and volumes in the millions.

The two most promising metaverses are Cornucopias (which we have already discussed in the dedicated lesson “Meta | What is metaverse and how it will be in the future”) and Pavia.

Pavia was the first metaverse to be built on Cardano and is named after the hometown of Gerolamo Cardano, the Italian scientist who inspired the name of the blockchain.

As for defi, there are dozens of dex and stablecoin-related projects, one among them “Ardana.”

Wallets

The two most widely used wallets in the Tezos ecosystem are:

- Kukai:

- Temple: