1.1- Monetary function development

In the lesson “history of currency: from barter to Bitcoin,” we listed the characteristic aspects of currency, its uses in the real world and the forms it can take.

In a nutshell, currency has been defined as: “that medium which arises to satisfy the need of economic subjects, carrying out commercial activities, production and exchange of goods and services, to transfer monetary resources among themselves.”

It is possible to make its classification into:

- Currency-commodities: consisting of goods that are endowed with intrinsic value, such as possessing a limited supply (gold) and/or real-world use for the creation of products (platinum) or the provision of services (copper).

Commodity-money has additional forms that differ in value based on the purity of the commodity used and the quantity present to constitute the coinage. - Sign-money: has almost no intrinsic value, consists of legal tender monetary kinds such as the euro or dollar, and materially consists of banknotes or metallic money.

Sign-money can take different forms, characterized by the establishment of a financial liability, for the party issuing it (e.g., ECB for the euro), and a financial asset for the holder (creditor).

1.2- Implications

The implications of these two different types of currency are that while the acceptance of commodity-money as a means of payment is contingent on the need of the receiving party, sign-money is based on the trust placed in the issuer.

1.3- Bank money and monetary function

As specified in Article 2082 of the Civil Code, “An entrepreneur is one who professionally carries out an economic activity for the purpose of production or exchange of goods or services.”

However, the entrepreneur must relate to third parties (entrepreneurs and non-entrepreneurs), and in order to transfer monetary resources from one party to another, he or she needs efficient tools that guarantee high speed of execution at low cost.

In order to meet this need, “alternative” currencies to legal tender, belonging to the category of sign-money, have been developed, such as the technical monetary function, which, by definition, makes available to the public and as a substitute for legal tender different instruments that can be used to settle exchanges.

Objectives of the technical monetary function are:

- Security: cancellation of the deterioration/dispersion of legal tender;

- Effectiveness: speeding up the transfer of resources.

- Dematerialization: no need for physical transfer of moved resources.

- Efficiency: low cost compared to other solutions due to the conveniences offered.

The monetary function is predominantly performed by banking institutions, which provide instruments for the transfer of financial resources, through methods such as:

- Bank check: the drawer (bank account holder) requests the drawee, his own bank, to pay a sum of money in favor of a beneficiary, which can be a natural or legal person.

- Cashier’s check: consisting of a promissory note issued by a bank authorized by the competent supervisory authority, national or supranational, by which the beneficiary can collect a specified sum of money.

- Bank transfer: a banking transaction requested by the customer in which he requests the transfer of money from a current account to a It is divided into two types:

- SEPA transfer: banking operation that can be implemented only with the Euro, consequently it is exclusive to the states of the Euro area (19) on (27) and others belonging to the European Union (15).

- Foreign transfer (SWIFT): banking operation implementable in all non-European countries and is implementable in different currencies (euro, dollar,yen…). For the past few years, the central banks of major countries, such as the ECB in Europe, the FED in the U.S., the Risksbank in Sweden, and the PBC in China, have begun to study and test the “Central Bank Digital Currency” (CBDC), which is a payment instrument other than money

The goal of these central institutions is to:

- Overcome the limitations of existing forms of payment;

- Promote financial inclusion by bringing 1.7billion users closer together.

Due to its technical-informatics structure, blockchain technology is able to lower costs for the institution operating the payment system.

Due to its technical-informatics structure, blockchain technology is able to cut down costs for the entity operating the payment system, charge lower fees to the customer, and greatly reduce the number of transactions per second.

For example, an economic signal (transaction) via Ripple’s blockchain, having the cryptocurrency “XRP” as its instrument, takes between 3 and 5 seconds, far shorter timelines than the:

- 2 business days required by SEPA wire transfer.

- 3- 5 days of the foreign transfer.

1.4- Blockchain and transparency

Blockchain possesses an inherent characteristic: transparency.

The blockchain, in fact, is a public and distributed ledger of transactions, where it is possible to unequivocally observe how users transfer or spend the blockchain cryptocurrency in question.

2.1- The subprime crisis

During the first decade of the 2000s, the market in the United States of America went through a rise in the value of real estate, as a result, the need for people to take out mortgages increased so that they could conclude the purchase of their homes and buy new ones.

Bankers tried to meet the market demand by providing credit even to individuals who, in fact, were unable to pay off the debt.

The mortgage provided at high risk of default took the name “sub-prime,” which, because of high default, was characterized by a very high interest rate.

The set of these sub-prime mortgages was “securitized”: the group of loans (mortgages issued) of each bank bank was sold as a single security in the market.

Since the financial institutions issuing those securities had stakes in the rating companies, they gave the sub-prime mortgages very high ratings (thus low risk of default) so that the institutions could easily sell them on the market. There was clearly a conflict of interest that no one took care of until the markets collapsed.

In fact, these securities were sold with very high ratings (hence low risk of default), assigned by rating companies, which were in a conflict of interest because they were maintained by the financial institutions that issued those securities.

I would remove the yellow sentence altogether and write this:

In fact, when many families were no longer able to pay their installments, their properties were foreclosed, causing a loss of property value, and a ripple effect was generated that affected the value of real estate securitizations. “And it was generated” is perfectly fine

This unleashed one of the greatest crises in modern history, where there was not only an economic failure of some institutions, such as Lehman Brothers, but also the breakdown of the trust system, resulting in a freeze, ordered by financial institutions, of assets and depositors’ money.

Especially problematic had been both the lack of transparency on the part of rating agencies and the total negligence on the part of banking institutions and intermediaries in securitizing and selling defaulted mortgages on the market.

The 2008 crisis involved a collapse of confidence on the part of market participants, and the following years were used to rebuild it.

It thus became imperative to create and develop a new tool, a medium capable of being transparent, whose information was available to every party, which was incorruptible and impossible to manipulate, without conflicts of interest and managed by a network of people, instead of centralized entities: the blockchain.

On October 31, 2008, at exactly 2:10 pm EDT, Satoshi Nakamoto published the Bitcoin white paper.

On January 3, 2009 at 6:18 pm EDT, the first blockchain block of Bitcoin was created and began a new era of finance.

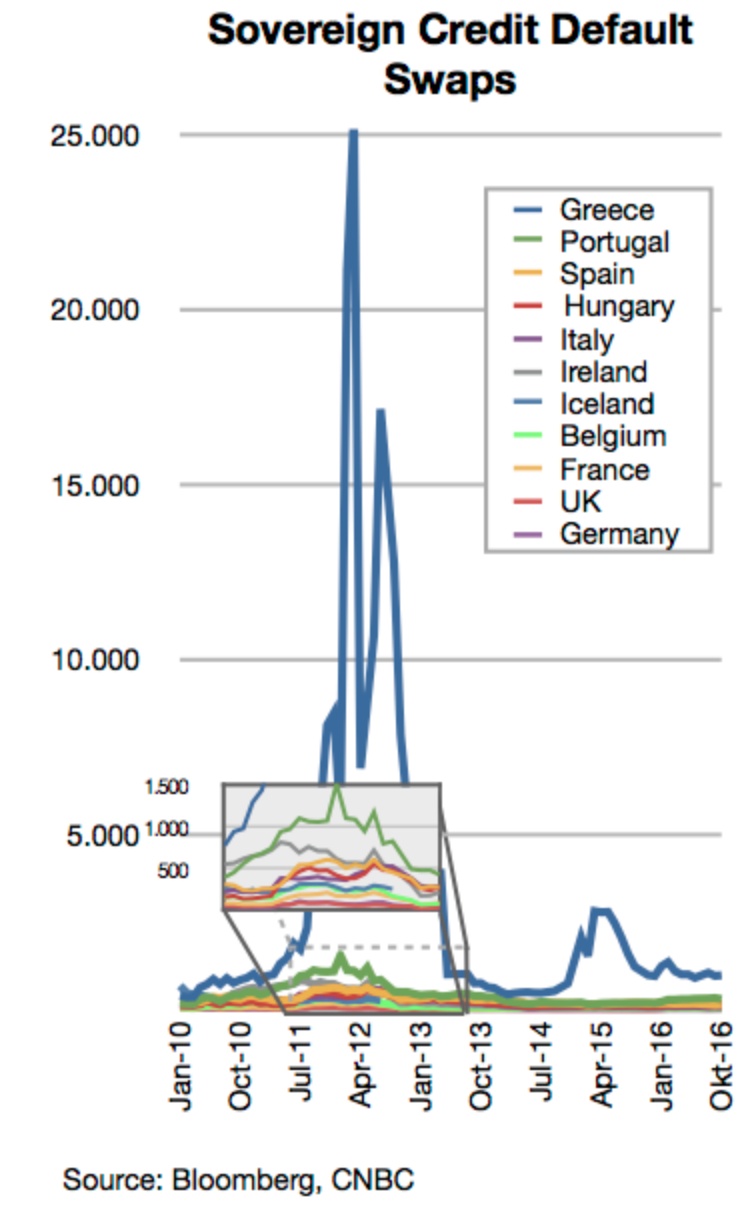

2.2- The sovereign debt crisis

Until 2008, many European banking institutions had purchased, trusting U.S. rating agencies, and held many of these instruments in their portfolios. Once the crisis broke out in the U.S., the most fragile institutions found themselves on the brink of default, so states were forced to smooth out their losses to avoid a domino effect on other European banks. This created an imbalance in public accounts and the explosion of national debts.

The means used to bail out European institutions was the “bail out,” which was later banned by European regulations except in cases of extreme necessity.

Such bailouts of systemically risky banks upset the public finance balances of countries with weaker economies, contributing to a contraction of their GDP and an unsustainability (or perceived unsustainability) of their overall debt (public, private and foreign).

The European sovereign debt crisis erupted at two different times: in 2010 and 2012, but it had the biggest media impact in 2015 in Greece.

The collapse of the housing market involved all sectors and brought to light all the problems caused by years of mismanagement by governments in Mediterranean countries, including the distortion of public budgets (in order to meet EMS access requirements), as public spending was used for welfarist and electoral purposes.

Thus were imposed by the European Central Bank, the European Commission and the IMF (ed. Troika) various austerity fiscal policies, aimed at cutting and streamlining public spending, in exchange for financial aid, such as monetary packages, to avoid imminent default.

The Troika acted in Spain, Portugal, Ireland and Cyprus with good results but at politically and socially high and unpopular prices; this is because frequently the fiscal restraint packages consisted of:

- Lowering salaries and/or firing civil servants;

- Extension of retirement age and recalculation of contributions;

- Sale (in parts and often at a discount) of public assets, also leading to privatization and liberalization of many strategic sectors.

The goal of such a harsh policy had been to bring the debt back from a divergent and explosive trend to a stable and decreasing one toward the parameters agreed upon in the Maastricht Treaty: that is, 60 percent debt/GDP, for which a deficit/GDP ceiling of 3 percent and annual growth of 5 percent on average was required.

Any budget deviation (deficit) was agreed in advance with European authorities even below 3%, so much so that Italy put a balanced budget in the Constitution, a goal that was actually never achieved.

3. Ripple and XRP

Within this framework, in 2013 “RippleNet” was born, founded by Chris Larsen and Jed McCaleb, who created a network for payments different from the traditional circuits of Visa and Mastercard, but also different from Bitcoin and other cryptocurrencies, which are characterized by a decentralized system.

Ripplelabs developed, in the manner of an institutional operator, an open source payments network, where a cryptocurrency was configured that would in fact function as a banking currency: “XRP.”

To this day, this network not only remains an open source protocol, but is also built on blockchain, which – as we all know – boasts important features, such as transparency, security and, consequently, trust.

Ripple’s network coins, XRPs, are owned on a par with an instrument issued by the bank that moves it, but it has advantages that other banking mediums do not possess, for example:

- Highly scalable transactions;

- Negligible fees, almost zero (0.25 XRP), due to the all-digital network that allows for lower costs;

- Global operating radius;

- End-to-end encryption, allowing the actor in the transaction to remain anonymous; (from “which” to “which”)

- Convertibility: ability to receive dollars or another fiat currency from a payer sending euros and vice versa

3.1- XRP and monetary policies

As a private currency, XRP can be the subject of unconventional and/or extraordinary policies, therapeutic to problems of all kinds without the regulatory-institutional constraints to which legal currencies must instead be subject.

3.2- Monetary Inflation

In Imperial-era Rome in 300 CE, the “Denarius,” a coin composed of silver, was used.

Over the course of imperial history, the value of the Denarius gradually declined, due to a reduction in the quantity and purity of the minting silver.

The decrease in the purchasing power of a payment instrument we know connoted by the term “inflation” this is expressible by the formula of the U.S. economist Irving Fisher:

P – Q = M – V

Where:

- P is the price of goods;

- Q is the quantity offered by the market of goods;

- M quantity of money;

- V velocity of circulation of money.

The decrease in the purchasing power of circulating money led to an increase in the quantity of money, which in the formula corresponds to “M.”

If we assume that M doubles, then the product to the right of the equal (M-V) will also double. For equality to be respected, the left member must also double, and it is precisely the value P (prices) that will increase since the supply of goods in the market remains the same.

To sum up: an increase in the amount of money in circulation corresponds to an increase in the price demanded by the market for a basket of goods.

Bank money is subject to inflation to the extent that the legal tender it represents is, which is true for both money-goods and money-sign, since they are all affected by the choices of the reference issuing institution.

3.3- Inflation of XRP

The cryptocurrency called XRP possesses its own inflationary flow: as a matter of fact, XRP happens to have a maximum total circulating supply of 100,000,000,000 coins, where the issuance of additional stocks to the quantity already present depends on the monetary policy adopted by Ripple Labs.

The increase in the dispositioned supply to date is 1 billion XRPs per month until the max supply is reached scheduled for 2038.

At the time of writing:

- Circulating supply = 48.11 billion XRPs

- Total supply = 99.989 billion XRP

- Maximum supply = 100 billion XRP