PREFACE AND WARNINGS

Providing guidance to those entering the cryptocurrency industry for the first time and to experienced investors/traders is the goal of the first chapter of the course“How to Buy Cryptocurrencies.”

In the following paragraphs, we will explain how a non-professional investor can easily buy cryptocurrencies in centralized exchanges (acronym: “cex”), which are basically similar to brokers.

An exchange is a digital platform, which can be a website accessible from a computer or an app accessible from a smartphone, where cryptocurrencies can be bought and sold. Exchanges constitute true marketplaces in the cryptocurrency industry and offer simple services, such as converting fiat currencies (euros, dollars, etc…) into cryptocurrencies, and complex services, such as leveraged trading of perpetual and non-perpetual futures.

Currently, the most prominent cex in terms of trading volume, notoriety, and security are: Binance, Coinbase, Kraken, Crypto.com, and Bybit. What distinguishes an exchange from a traditional financial broker is that a cex offers very few legal guarantees in case of problems; this situation is the result of the indecision of many countries’ legislative bodies on how to incorporate cryptocurrencies into the national and international economic-legal system.

Before delving into the tutorial, it is worth mentioning that centralized exchanges do not have a very good reputation in terms of reliability, so the basic advice that can be given is as follows: do not invest more than you are willing to lose.

In particular, exchanges are prone to hacker attacks and damage caused by the incompetence or dishonesty of their managers, and these are the main causes of the huge disasters that have occurred in the history of the cryptocurrency industry:

- As for hacker attacks, recall that in February 2014 about 850,000 bitcoins were stolen from the cex called “Mt. Gox”

- As for incompetent or dishonest management, the fraudulent operations of FTX and Alameda Research (an exchange and a related fund, respectively) were revealed in November 2022; the house of cards collapsed when users started withdrawing their funds from the cex and when the price of FTX’s utility token (FTT) dropped to near zero.

With that said, let’s proceed with the steps to follow to buy cryptocurrencies.

QUICK AND EASY REGISTRATION

Unlike many other investment classes, cryptocurrencies are easily accessible by anyone with a smartphone or computer and an Internet connection.

The quickest and easiest way to invest or trade cryptoassets (a term that includes NFTs) is to register with a centralized exchange.

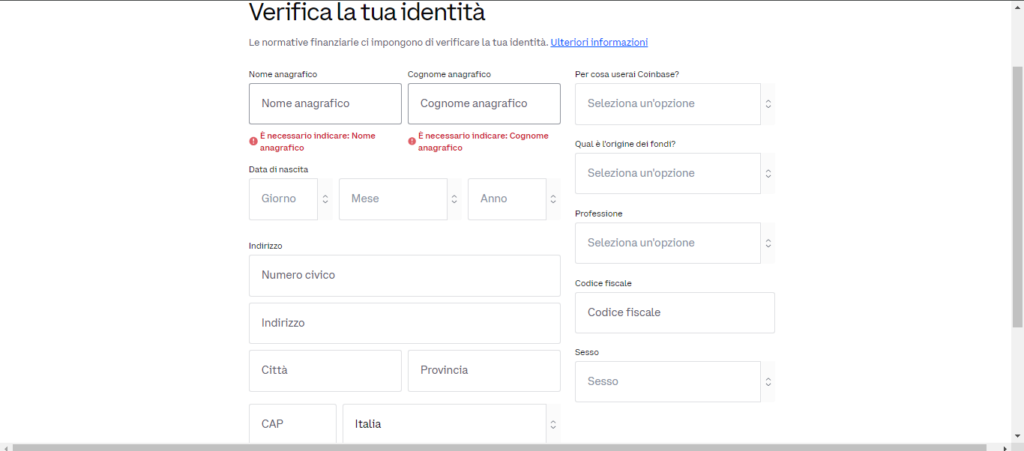

After downloading the App in his smartphone or after searching the web for the corresponding link, he proceeds with the registration, which must comply with the KYC (Know Your Costumer) and AML (Anti Money Laundering) principles.

In a nutshell, the legislature has imposed an obligation on major exchanges to register only those who have an ascertainable identity and are not involved in illegal activities, particularly tax evasion and money laundering.

Let’s see what steps to follow:

- You enter your cell phone number if using a smartphone or e-mail address if using a computer;

- You provide the essential personal information to create a new account in the exchange, namely your first and last name;

- You are almost always asked to confirm your e-mail address with a test e-mail and enter your cell phone number, to which you are sent a code that you must then enter in the app or site where you are registering;

- You proceed to enter the strictly necessary biographical data, based on what was said earlier about KYC and AML;

- Youupload a legally valid personaldocument, such as an ID card or driver’s license, certifying both the veracity of the personal data and the fact that you are a natural person (and not a bot);

- It expects a response from the exchange, which may ask the user to upload the ID photo again if it is blurry.

This first part of registration should take no more than 10-15 minutes.

The images are an example of how Coinbase has organized the registration process, but other exchanges’ procedures are similar.

SECURITY SYSTEMS AND BANKING DATA

If all has gone well, you need to complete the registration process, and although there are some differences depending on the exchange in question, it is usually necessary:

- You set up security systems, such as PIN, password, 2-factor authentication (2FA), anti-phishing code, and so on;

- Youenter the bank details you wish to use for transfers to/from the exchange;

- In many cases, you can also register your credit/debit card to make small/medium deposits quickly.

USEFUL SETTINGS IN THE APPLICATION

Once you have made your deposit in your fiat currency (in our case it is euros), you can start trading in the way that best suits your risk appetite, your goals, the time you can devote, and so on.

To provide an overview of the trading that can be done in the stock market, the main activities are as follows. In fact, it is possible to:

- Buy and sell cryptoassets “spot,” that is, converting euros into cryptocurrencies and vice versa;

- Trading on margin (with leverage) with perpetual and expiring futures derivative contracts;

- Staking a certain amount of coins of a cryptocurrency and/or stablecoin to earn a return, a concept reminiscent of investing in bonds;

Each exchange has its own interface design and details, but it is widely believed that Coinbase is the easiest to use compared to the others.

However, to cite an example widely shared by industry participants, not all that glitters is gold: the fees to be paid for buying and selling cryptocurrencies on Coinbase are very high compared to competitors.

HOW TO INCREASE SECURITY

Reconnecting with what was said in the first paragraph, there are numerous steps that everyone can implement to increase the level of security of their capital and investments.

First, the procedure just described should be applied twice: it would be best, as with a bank account, to register in two or more centralized exchanges and divide the capital into two or more equal parts.

In this way, if an event similar to what happened in November 2022 with FTX occurred, one would not lose all the capital, but only a part.

Also following this logic, one can trade cryptocurrencies within a bank account that offers such services, for example Hype (Banca Sella Online) or Fineco.

However, one has to consider that centralized exchanges offer the services listed above in a much more efficient, practical and comprehensive way than banks, because the latter may not have developed them adequately, as that is not their core business.

In addition, not all banks allow one to withdraw purchased cryptocurrencies directly from his or her bank account and transfer them – for example – to an offline wallet, whereas cex do.

In this regard, those who wish to further increase the degree of security can transfer cryptocurrencies they wish to hold for a medium to long period of time into an offline wallet (also called a “hardware wallet,” i.e., physical).

Let’s describe very briefly what a hardware/offline wallet is: it can be compared to a “flash drive” (like the classic USB stick) that contains cryptocurrencies purchased on a centralized or decentralized exchange and transferred into it.

This is an additional step in the area of managing one’s funds in cryptocurrencies: on the one hand, it requires knowledge of how private keys, public keys, addresses and other elements work; on the other hand, it almost totally eliminates the dangers we described earlier. For example, it decreases the risks of hacker attacks and of suffering damage due to incompetence of cex management in handling the activity.

We will see in other chapters of this tutorial series how to use an offline wallet.

CONCLUSIONS

The cryptocurrency industry has been around for about a decade and is likely to continue to develop in the coming years, but keep in mind that there are both many risks and many rewards.

What has just been described is the path that most people entering this industry for the first time take.

New methods of investing in cryptocurrencies come from traditional finance: the approval of physically replicating ETFs on Bitcoin and Ethereum are a prime example, and in fact we have discussed them in specially dedicated lessons.