On June 15, 2023, BlackRock, the world’s largest U.S.-based investment company with an Asset Under Management (AUM) of allâincirca 10 trillion U.S. dollars, filed an application with the U.S. Securities and Exchange Commission (SEC, which corresponds to the Italian CONSOB) for a âETF spotâ on Bitcoin (ETF stands for âExchange-Traded Fundâ), designating Coinbase Custody Trust Company as the custodian of bitcoins and the manager of the holdings in fiat Bank of New York Mellon.

However, the financial instrument for which BlackRock has filed with the SEC is not a spot ETF, but a trust, as in fact is denoted by the name of the fund itself âiShares Bitcoin Trustâ. The term âspot ETFâ (or even âspot ETFâ) certainly attracts the attention of the retail investor, but with a deeper analysis it is possible to understand the real nature of such a financial instrument. In this article we will use the terms âtrustâ and âspot ETFâ as synonyms because the substance of the discourse in fact does not change.

The SEC has so far allowed funds to operate financial instruments that track cryptocurrency futures or own shares in companies with indirect exposure to cryptocurrencies (e.g., Microstrategy – MSTR), but has rejected all applications to establish a spot ETF.

Spot prices are how derivatives traders in the options and futures markets refer to asset prices with immediate delivery rather than future delivery. In simpler terms, the spot price is the current price of an asset at the current time, rather than assumptions about what the price might be in the future.

DOES BITCOIN REALLY NEED A SPOT EFT?

Divergence of views on the topic

This concept is not of secondary importance, and the answer varies depending on who is asked this question.

Onthe one hand, bitcoin was founded in 2008 by Satoshi Nakamoto with the idea of being a âpeer-to-peerelectronic cash systemâ, so simply put, a kind of digital cash in the hands of ordinary people, who should become the bank of themselves; the approval of a spot ETF would imply that banks and investment funds, which will offer this financial product to their clients, will have to take possession (probably through third parties) of a substantial number of bitcoins, and the more successful this product becomes, the more bitcoins they will have to buy: the result would be a change of hands from small investors to large investors, distorting the cardinal principles of bitcoin enunciated at the outset.

On the other hand, the potential for growth in the capitalization and adoption of bitcoin would remain limited without an instrument that is capable of potentially accommodating trillions of dollars with the proper guarantees and securities. Indeed, it could be said that with the bull run of 2020-2021, a significant peak in Bitcoin capitalization and adoption has been reached, so in the eyes of a long-term investor it would be best to see the entry of new capital to structure a positive price trend that will persist for a long time.

Thus, it could be said that Bitcoin does not need a spot ETF to exist, yet it would give a huge boost to its price and spread and, cascadingly, to the entire crypto sector, as a rotation of capital to Ethereum and altcoins, as well as to the companies that support the sector, would subsequently take place.

Speculation or diversification?

Bitcoin being a relatively new financial asset in the global market, institutional investors have mentioned on a few occasions that they would be willing to invest in Bitcoin as their clients would not mind the idea of allocating a small part of the portfolio for short-term speculation or with a view to diversification over the long term.

When we talk about institutional investors we mean not only investment funds and banks, but also professional investors and listed companies. There are not a few institutional investors who would like to get a secure and guaranteed exposure to Bitcoin, but at the moment they do not have the slightest possibility of accessing the crypto market. They also have no idea how to manage the coins on the balance sheet because they lack both regulation and a regulated financial instrument that would allow major investors to allocate substantial capital.

A similar argument can be made for the large share of the market consisting of retail investors who could and would like to invest in Bitcoin, but who do not take the necessary next steps to enter the market. As trivial as it is, the cause often associated with not entering the crypto sector is that Bitcoin is difficult to buy. Indeed there is a kernel of truth in this statement, since to buy it one has to register with a broker (which in the crypto sector is called âexchangeâ) via either smartphone or pc, almost always providing a lot of personal data, and wait some time to receive confirmation of registration. You have to deposit some money, assuming your bank agrees to the transfer, and such money is almost never guaranteed should a scam (phishing, hacking, etc.) occur.

At that point one can finally buy bitcoin, but it would be better to transfer it to a cold wallet, since leaving one’s bitcoins on exchanges is not safe: for example, there could be a cyber attack or the failure of the exchange itself, which would result in the loss of funds. As if that were not enough, such funds would also be lost forever if the private keys of the hardware wallet were lost.

It would be much simpler and more accessible for many people to buy bitcoin directly from their bank accounts, somewhat like what happens with gold.

There are similarities with the yellow metal

In this regard, a spot ETF on bitcoin would be conceptually similar to the SPDR Gold Trust, which is an exchange-traded fund (ticker: GLD) and offers investors the opportunity to invest in physical gold without having to buy and store physical gold itself .

The fund purchases physical gold bars and keeps them in safe storage. Investors can purchase units of this fund, which represent a fractional ownership of the gold held by the fund, and each ETF unit is generally designed to represent a fraction of an ounce of gold.

Investors can trade SPDR Gold Trust shares on an exchange, just as they would trade a company’s stock. This offers them greater liquidity than buying physical gold bullion directly, which can be less convenient to manage and trade.

The main goal of SPDR Gold Trust is to provide investors with a simple and efficient way to gain exposure to gold price movements, just as would happen with Bitcoin.

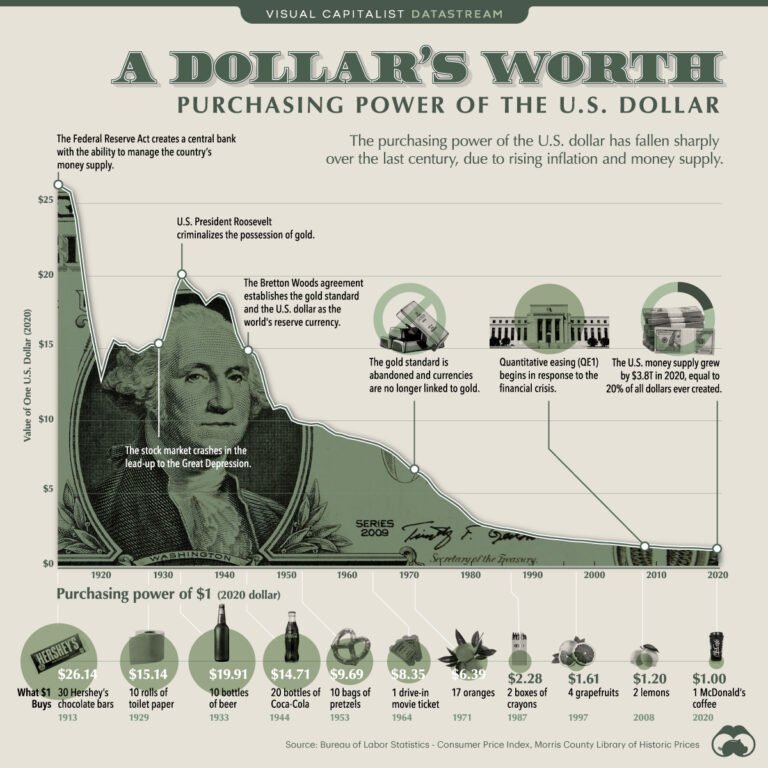

It could be said that there are similarities between the two assets themselves, in that gold acts as a hedge (in English: hedge) against the devaluation of fiat currency and during periods of economic recession.

Without going into too much detail, a hedge/hedge in financial markets is a strategy used by investors to reduce or mitigate the risk associated with adverse movements in the prices of financial assets in their portfolios. The main objective of a hedge is not necessarily to make a profit, but is to protect an existing investment from potential losses, allowing investors to manage market risk more effectively.

History teaches that any fiat currency that is used as a global reserve currency and that is used for international trade has an average life that can vary from a few decades to several centuries, depending on the economic, political and social factors that influence its acceptance and stability in the international context.

Since 1944, in the Bretton Woods agreements, the U.S. dollar has emerged as the prevailing currency in international trade, and its devaluation against real assets is irrefutable, particularly after August 15, 1971, when the U.S. abolished the convertibility of the dollar into gold (Gold Standard).

As of March 2021, inflation in the U.S. has exceeded the critical threshold of 3 percent and June 2021 that of 5 percent until June 2022 when it reached 9 percent, but in the European Union it was even worse. Currently, inflation has not yet been tamed by central banks, so owning money sitting idle in current accounts is not convenient if it is to be used in the purchase of goods.

Could bitcoin behave like physical gold?

Bitcoin as  “digital gold”

Bitcoin has been defined as a commodity, just as gold is, so it is under the supervision of the Commodity Futures Trading Commission (CFTC) and, like the yellow metal, may represent an anti-inflation hedge/hedge against a fiat currency that is continually being devalued by expansionary monetary and fiscal policies.

Its strength actually lies in its ability to be trustless, that is, the ability to transfer value without relying on centralized third parties. In a sense, trust is placed in its blockchain and the decentralized and distributed network of miners and nodes that guarantee and confirm transactions.

Bitcoin could thus be regarded as a “hard asset” (physical asset), that is, a store of value. This expression is used in the context of traditional finance to describe tangible assets with intrinsic, tangible, physical value. These assets are considered “hard” because they do not depend on trust or a promise of payment from another party, but are based on their own intrinsic value and actual demand in the market.

Hard assets can include a wide range of assets, including:

- Precious metals

- Real estate

- Commodities

- Works of art and collectibles

- Etc.

Investors often view hard assets as a form of portfolio diversification, since they can act as buffers against fluctuations in either the stock market or currencies. However, it is important to note that hard assets can bring specific challenges, such as the need for conservation, price volatility caused by geopolitical shocks, changes in global demand, and so on.

In the case of Bitcoin, we know that changing its blockchain requires gaining control of at least 51 percent of the hashing power (hash power) of the network. Hashing power refers to the computational capacity of the Bitcoin network, which is used for the mining process and confirmation of transactions. A 51% attack on Bitcoin would require enormous computational and financial resources because it is protected by a vast network of miners.

Added to this stability and immutability of its network is the concept of scarcity, that is, a fixed maximum supply of 21 million coins, and transparency, that is, a circulating supply that can be traced thanks to the blockchain. All of which make Bitcoin a hard and resilient asset.

Resilience also comes from having passed various tests over the course of its history, for example: major exchanges failing or being hacked, the victory of the âblock-size warâ in 2017, numerous ban attempts by major countries (e.g., China), and a period of high interest rates and tight monetary policy.

In an increasingly unpredictable and uncertain world, the security derived from predictability gains value.

DESCRIPTION OF THE QUESTION ADVANCED BY BLACKROCK

The following is a quote taken from BlackRock’s submission to the SEC: âThe Shares are intended to constitute a simple means of making an investment similar to an investment in bitcoin rather than by acquiring, holding and trading bitcoin directly on a peer-to-peer or other basis or via a digital asset exchangeâ. Translated: âThe shares are intended to provide an easy means of making an investment similar to an investment in bitcoin rather than by acquiring, holding and trading bitcoin directly on a peer-to-peer or other basis or via a digital asset exchange.â

According to experts, BlackRock is proposing a fund that would abide by rules that specifically address the problems, concerning the crypto sector, that the SEC has cited in rejecting applications filed in the past by other investment companies. In essence, BlackRock has applied to form a trust.

Process of forming a physically replicating ETF

- Design: defining the structure, so what the replicated asset will be, how it will be replicated, what the reference ticker will be, how much the fees will be, and so on;

- Regulation: required approval by the Securities and Exchange Commission;

- Seeding: step that usually occurs following SEC approval and consists of the raising of investor capital by the issuer of the instrument;

- Purchase of the asset: using capital from investors;

- IPO.

It appears that BlackRock intends to start phase (3) of âSeedingâ before phase (2) âRegulationâ, as it would take SEC approval already for granted, but it is better not to rush into rash assumptions.

To be monitored very closely at the time of listing will be the amount of capitalization of the spot ETF and investor demand for the instrument over the following weeks and months.

Differences between ETFs and Trusts

An ET F (Exchange-Traded Fund) is a type of exchange-traded fund. Conceptually similar to a mutual fund, an ETF raises risk capital from investors and deploys it to buy a wide range of financial assets, such as stocks, bonds, commodities or market indices.

ETFs are designed to replicate the performance of a specific index or basket of assets, allowing investors to achieve automatic diversification and relatively low management costs. By buying a share in an ETF, you take a position in a small part of the ETF’s entire portfolio.

MAIN FEATURES:

- Liquidity: being exchange-traded, investors can buy and sell shares during trading hours with ease and speed.

- Diversification: ETFs often include numerous financial assets, making them a diversified investment vehicle.

- Transparency: by law, portfolio composition is published regularly, allowing investors to know exactly what assets they hold.

- Costs: fees are generally lower than those charged by traditional investment funds.

- Flexibility: investors can trade units at any time during market hours, unlike mutual funds that are valued once a day at market close.

ETFs have been and still are very important financial instruments in terms of retail accessibility to traditional financial markets.

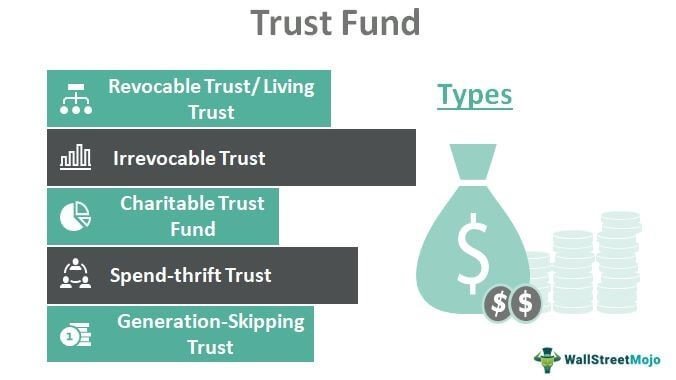

A trust, in Italian âtrust fundâ, is an estate planning tool that consists of a legal entity that holds property or assets for a person or organization. Trusts can hold many different types of assets, including money, real estate, stocks, bonds, a business, or a combination of many different types of property or assets.

Trust funds can take many different forms and can be established under different terms. They offer some tax advantages, as well as protections and financial support for the people involved.

KEY POINTS

- A trust is designed to hold and manage assets on behalf of a specific person, with the help of a neutral third party.

- Trusts include a grantor, a beneficiary and a trustee.

- The grantor of a trust fund can set the conditions for holding, collecting or distributing assets.

- The trustee manages the assets of the trust and carries out its directives, while the beneficiary receives assets or other benefits from the trust.

Trusts can be revocable and irrevocable, and there are several variations of them for specific purposes, but we will not go into those details here.

FINANCIAL PRODUCTS CURRENTLY AVAILABLE FOR BITCOIN

| NAME | DATE OF RELEASE | PLATFORM | TYPOLOGY |

| Grayscale Bitcoin Trust (GBTC) | september 25, 2013 | OTCQX* | Trust |

| CME Bitcoin Futures (BTC1!) | december 17, 2017 | Chicago Mercantile Exchange (CME) | ETF futures |

| Purpose Bitcoin ETF (BTCC) | february 18, 2021 | Toronto Stock Exchange (TSX) | Spot ETFs |

| ProShares Bitcoin Strategy ETF (BITO) | october 18, 2021 | New York Stock Exchange (NYSE) Arca | ETF futures |

*OTCQX is an over-the-counter market operated by OTC Markets Group.

BlackRock learns from the mistakes of others

It is very likely that BlackRock over the years, although CEO Larry Fink has given interviews with conflicting views on Bitcoin over the years, has patiently observed the many vicissitudes faced by institutional crypto players (exchanges, funds, etcâ¦) and regulatory and oversight bodies in the US. One would think that BlackRock has the intention of correcting mistakes made in the past by other institutional players, and a case in point is Grayscale.

A major drawback of GBTC, which is an ETP (Exchange Traded Product), accessible only to professional investors, is that it often trades at a premium or at a discount to the market value of its underlying asset (GBTC premium/discount to NAV, where NAV stands for Net Asset Value). At the end of 2022, the discount was about 50 percent. Following BlackRock’s application, the discount was reduced to about 33 percent. With the victory by Grayscale in its lawsuit against the SEC, the NAV discount has been further reduced due to the hype generated around the approvals of these spot ETFs.

GBTC trades at a discount because investors can sell their shares in the market, but have no way to redeem their holdings in exchange for bitcoins belonging to the fund. Among other things, Grayscale charges shareholders a 2% commission (very high), so one has to consider these costs when trading GBTC.

Could the same problem affect investors in BlackRock’s proposed trust? Theoretically yes, but it appears that BlackRock has agreed with market makers to create the opportunity for arbitrage in a secondary market for the trust’s shares. This could avoid price discounts and premiums, meaning that BlackRock’s trust could act de facto as an ETF and avoid the problems that plague Grayscale’s trust.

Grayscale would like to convert its trust into a spot ETF to list it on the âArcaâ division of the NYSE (New York Stock Exchange) and to do so requires qualification by the SEC, but there has been a lawsuit between Grayscale and the SEC. ETF futures, on the other hand, are listed on the CME (Chicago Mercantile Exchange) and so far the SEC has approved all of them.

What has emerged from the legal dispute between Grayscale and the SEC is that, on balance, the regulator is concerned about three specific elements:

- âDispropotionate shares of the marketâ: the SEC is concerned that Grayscale’s spot ETF could influence/manipulate the price of Bitcoin by gaining too large a share of the market;

- âAffected by fraudâ: the SEC is concerned that if some kind of fraud occurs in the Bitcoin market, investors who bought the spot ETF will be affected;

âFair pricingâ: the SEC is concerned that price distortions will occur, such as the spot price of Bitcoin being very different from the spot ETF.

OBSTACLES TO OVERCOME

The Security and Exchange Commission is hostile

Although Gary Gensler, the chairman of the SEC, is in favor of blockchain as a technology, he is nevertheless disinclined to favor the adoption of Bitcoin and is decidedly hostile toward altcoins. In some of his statements it has emerged that the digital dollar is more than enough to carry out transactions (just think of the FedNow), so the use of cryptos is, in his opinion, totally unnecessary.

So far, all applications for a Bitcoin ETF Spot for the US have been rejected by the SEC, and the reasons that have been formally given to justify this skepticism are as follows:

- Lack of market transparency; the SEC has expressed concerns about possible manipulation of the cryptocurrency market and price volatility due to lack of regulation.

- Risks of fraud and market manipulation; the SEC is concerned about the ability to monitor and prevent fraud and market manipulation due to the relative anonymity of transactions and believes it may be more difficult to monitor suspicious or fraudulent activities.

- Insufficient oversight: the SEC said the proposals did not meet market surveillance requirements. Specifically, they failed to demonstrate the existence of shared oversight arrangements with a significantly connected market, an essential criterion for establishing an ETF.

Simply put, the operations of cryptocurrency/cryptoasset exchanges are not the most transparent, as fraud and manipulation are believed to occur. For example, the collapse of FTX in November 2022 inadvertently triggered by Changpeng Zhao, the CEO of Binance, proved that the concerns of the SEC Chairman are not completely unfounded.

Simply put, the problem, from the SEC’s perspective, is not so much the cryptos themselves as it is the operators in this sector.

Congress has not been unbalanced

The absence of clear and precise regulations is definitely the fault of the U.S. legislature, and as things stand, the crypto sector is in a kind of Mexican-style stalemate. The crypto sector is very innovative and fast-paced, but it is not âmature enough, that is, it would not have the right requirements to be regulated properly.

One example is the legal dispute between Coinbase and the SEC over what services the U.S. exchange could offer users: since there are no precise laws, to figure out how to operate in this market they resort to the judiciary with the idea of carrying out âregulation through litigationâ, which is not a good way to bring clarity to the crypto sector in the long run, although in the short run it can solve circumstantial issues.

As anticipated in the previous paragraph, another reason behind the reluctance on the part of Congress to legislate was the chaos resulting from the FTX implosion, in which an estimated $8 billion was lost.

In addition, in the vein of some of Gary Gensler’s statements, important political-ideological issues should be highlighted: for example, some green economy figures argue that Bitcoin’s Proof-of-Work (POW) pollutes the environment.

Obviously, the main reason â as mentioned a moment ago âlies in the competition that cryptos make to the U.S. dollar, so it is believed that any pro-crypto legislative intervention is to the disadvantage of the dollar. Recall that the U.S. dollar is the global reserve currency, as well as the only fiat currency that can be used to exchange oil (petrodollar), so the United States bases much of its economic-financial power on the dollar and anything that threatens this hegemony tends to be blocked.

POSSIBLE SCENARIOS

The SEC has few options available

So, although financial products already exist, a spot ETF on Bitcoin approved by the SEC in the U.S. and managed by one or more U.S. investment funds (such as BlackRock), does not yet exist. If a spot ETF were to be approved in these terms, it would be a definite game changer, since there is currently no financial market in the world equal to or larger than the U.S. in terms of liquidity and capital. In addition, it is highly unlikely that U.S. institutional investors would decide to export their capital to invest in Bitcoin abroad, much less if there is a lack of securities and guarantees from regulators.

We speculate on possible scenarios regarding the ETF spot in general:

- The SEC postpones approval for many years.

If the world’s most important investment funds apply for a financial instrument, then they surely want to receive a clear-cut answer from the regulator, regardless of whether it is positive or negative. Moreover, stalling indefinitely would damage the SEC’s reputation, as it would be like holding Bitcoin and the crypto sector hostage.

- The SEC denies approval immediately.

On balance, the SEC always makes the usual justifications for denying approval, but it is losing major cases against some crypto players (see Grayscale case). A firm and immediate rejection could be a kind of signal that this sector is still too much affected by fraud and manipulation, so it would still take a long time to get it in order.

- The SEC will approve it in due course.

It must be admitted that when big U.S. investment funds ask for something, it’s hard for them not to get it. BlackRock through its domestic and international investments has significant economic-political power. However, it would be very strange if the SEC approved spot ETFs just after the applications were submitted to it by the investment funds, since the crypto sector has not yet passed the requirements that the SEC considers essential for approval. For example, although many businesses based on Ponzi schemes or based on scams failed in 2022, there are still firms that refuse to have third parties audit them.

At this point it makes sense to speculate on what would happen if any of these scenarios were to occur, but nothing that will be written constitutes financial or investment advice.

Knowing that demand for Bitcoin would increase considerably and that supply is scarce and unchangeable, one can imagine that spot ETFs would give a huge bullish boost to the price: in other words, a supply shock would occur. One must ask whether BlackRock and, in general, Wall Street are willing to consciously accept late entry into the cryptocurrency world, given that Bitcoin was born in late 2008.

The following phenomenon usually (but not always) happens in the financial markets: generally, retail investors enter the markets due to FOMO (Fear Of Missing Out) when stock prices are already very high, and in fact, institutional investors, who usually invest when prices are low, sell their securities precisely to small investors, after which the prices tend to fall and small investors sell at a loss. At that point, who buys the securities sold by retail investors? When prices return to acceptable levels, institutional investors regain control of the situation.

Potential consequences for the crypto sector

Speaking of the short-to-medium term (3-6 months), the hype generated by the approaching approval of spot ETFs and the approval itself would likely cause a surge in the price of bitcoin, thus benefiting long-term holders, miners, and other market participants who hold a lot of bitcoin. Investment funds, on the other hand, would settle for a small slice of the pie because they would find themselves buying the bitcoins they need to be able to offer their ETFs at a sky-high price. In essence, a reversal of the customary market dynamic would occur.

One wonders what would happen if Wall Street decided to buy at a discount the bitcoins needed to constitute spot ETFs. In that case, it would not be strange to see a kind of total cleansing of the competition:

- FUD (Fear, Uncertainty and Doubt) could be spread through the mass media to influence holders to such an extent that they would sell their bitcoins;

- Regulators and regulators around the world could legally attack what Wall Street sees as competitors, such as exchanges, sending them âout of businessâ;

- Manipulations could take place the price of bitcoin so that it remains below the profitability threshold for miners for a long time, who would be forced to sell their bitcoins en masse to finance their debts and avoid bankruptcy.

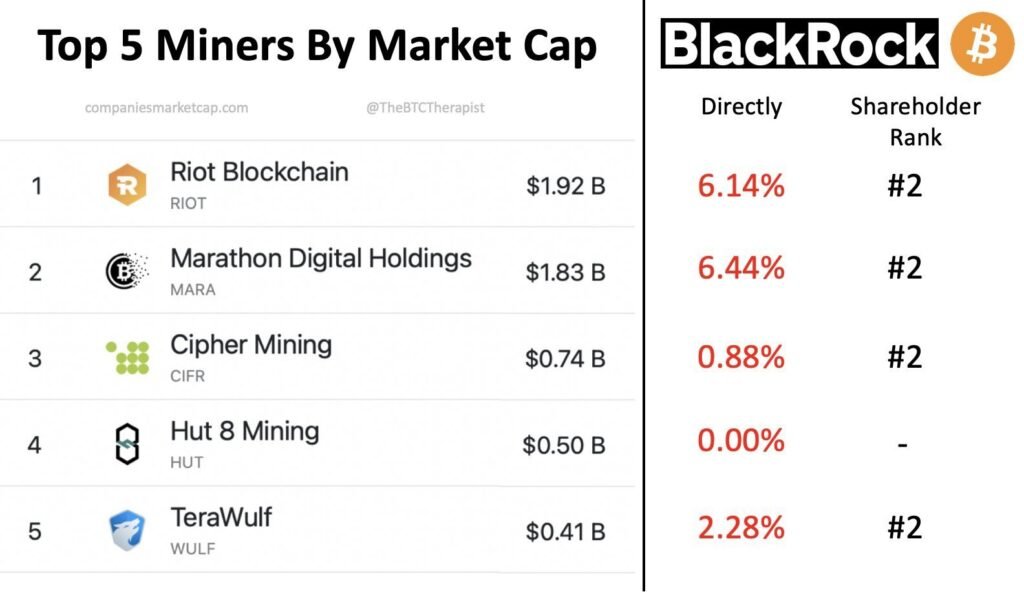

BlackRock has invested a lot of capital in bitcoin miners, and this is not a coincidence, because miners hold approximately 1.8M bitcoins on their balance sheets. The hash rate is currently extremely high, so there is a lot of competition among miners to grab the fee (6.25 BTC) derived from the formation of a new block every 10 minutes. It is estimated that at the time of Bitcoinâhalving in 2024 its price will need to be between $40,000 and $50,000 for miners to be profitable.

The price of Bitcoin is set by the trading that takes place in spot exchanges, so if miners were under pressure, they would sell their bitcoins to avoid bankruptcy and this would lower the price. A scenario in which the price of bitcoin is not impacted by those sales could occur when BlackRock buys in OTC (Over-The-Counter) at a steep discount bitcoins directly from the balance sheets of failing miners, since it is shareholder in many miners.

If the price were to fall for any reason below very important technical support levels, e.g., the $15,000 touched in 2022, everyone who has bought and owned bitcoin since the beginning of the November 2020 bull run would be at a loss. A general panic selling could occur, and who would be ready to buy all these coins?

- Investment funds like BlackRock, because at that point they would have the green light from the SEC to offer spot ETFs or trusts to their clients;

- Listed companies, because they could include bitcoins on their balance sheet as an investment;

- Banks, because they could offer their account holders the opportunity to buy bitcoin or otherwise easily gain exposure to bitcoin price movements.

Staying in the short term (3-6 months), without assuming overly catastrophic scenarios, a bitcoin price fluctuation between $40,000 and $20,000 by the end of 2023 and the first half of 2024 would be plausible, especially if BlackRock’s main competitors in theETF, e.g., Binance, got into serious trouble. This scenario would constitute a kind of echo-bubble of Bitcoin’s price: a kind of mini-bubble that mimics the one formed in the bull market of 2020-2021.

The same phenomenon occurred in 2019 with an echo-bubble mimicking that of 2017. The deflation of the mini-bubble could begin with the euphoria that would spread through the crypto sector in the weeks leading up to the likely approval dates of the spot EETF.

Turning to the medium to long term (6-24 months), if the U.S. and global economies find themselves macroeconomically in recession or stagflation either in the coming months or years, an interest rate cut and a return to QE (Quantitative Easing) would likely follow sometime between 2024 and 2025.

This scenario would bring major upheavals in financial asset prices, but the 2024 halting development of artificial intelligence, which in itself favors technology and innovative sectors such as crypto, would theoretically form the foundation for the start of a new bull run for Bitcoin.

If the Bitcoin ETF spot is successful, it would not be strange to see a definite decrease in the volatility of its price, regardless of the macroeconomic scenario that will come to be established. In this case, the strong demand for this asset would greatly increase its capitalization, consequently reducing the number of extreme bullish and bearish swings in its price.

Historical comparison between GLD and BTC

GLD â as mentioned at the beginning of the article â corresponds to the ticker of the gold spot ETF, which was approved in November 2004.

Bearing in mind that there is still no certainty about the approval of IBTC, which is supposed to be the ticker of the BlackRock trust, let us try to examine what happened to GLD starting from its launch date, i.e. 2004:

- Of course a buy the rumor sell the news occurred that caused GLD’s stock price to lose a little over -10 percent;

- This was followed by about a quarter of consolidation/accumulation within well-defined support and resistance;

- Bullish breakout and the beginning of the bull run for the gold price, which was briefly interrupted in May 2006, suffered a setback with a retracement of -34Ú May to October 2008 and ended in September 2011 totaling a 350% since the 2005 accumulation phase.

The first phase of the gold bull market, i.e., the one starting in 2005 and ending in 2008, which totaled about 140%, as that increase was almost certainly due to the possibility for investors to get easy exposure to the gold price. The second phase of gold’s bull market, the one from 2008 to 20011, was most likely driven by the Federal Reserve’s QE and ZIRP, i.e., the U.S. central bank’s extremely expansive monetary policy (QE = Quantitative Easing; ZIRP = Zero Interest Rate Policy).

The price of Bitcoin could theoretically follow the first bull market phase of gold just mentioned, but this will happen if and only if the Bitcoin ETF spot is successful.

Although many institutional investors have indeed repeatedly stated that they want to invest in Bitcoin, it will have to be seen whether they will go from saying to doing by the time the spot ETF is approved by the SEC: one should never take anything for granted, especially when it comes to the crypto sector.

TIMELINE FOR APPROVAL

Data extrapolated from Bloomberg Intelligence on applications submitted to the SEC:

In any case, the pressure from BlackRock, which is a very powerful institution, on the SEC regarding trust approval will allow other U.S. investment funds, such as Fidelity, Invesco, Wisdomtree, etc., to apply for their own trust or spot ETFs and receive the green light from the SEC: approved one, they all get approved.

Many believe that the issue is the âwhenâ and not the âifâ these financial instruments will be approved, but there is still a long way to go and most likely we will have to wait until March 2024.

Updates

OnFriday, August 11, 2023, the SEC stated that it needs more clarification regarding the application for approval of the 21Shares Bitcoin exchange-traded fund (ETF) proposed by ARK Invest, with the implicit intention of delaying (for the second time) its final verdict, as presumably doubts about the crypto sector have not yet been dispelled.

On Tuesday, August 29, 2023, the SEC lost its case against Grayscale regarding the review and evaluation of the proposal to convert the GBTC trust into a spot ETF for Bitcoin. The judge ruled that the SEC did not prove: that a fraud would impact the price of Bitcoin; that there is a disconnect between the price in the spot market and the price in the futures market, so it makes no sense to approve a futures ETF and deny a spot ETF; how Grayscale’s spot ETF could strongly influence the price of Bitcoin. This does not under any circumstances compel the SEC to approve such a conversion, but it does compel them to identify new reasons not to approve Grayscale’s spot ETF. It is very likely that the SEC, within the statutory limit of 45 days, will appeal.

On Thursday, August 31, 2023, the SEC postponed its decision on the approval of: WisdomTree Bitcoin Trust, Invesco Galaxy Bitcoin ETF, Valkyrie Bitcoin Fund, Wise Origin Bitcoin Trust (by Fidelity), Bitwise Bitcoin ETP Trust, and finally iShares Bitcoin Trust (by BlackRock). Although it is off topic, on the same day the Bitwise fund withdrew its application for approval of the Ethereum futures ETF.

On Tuesday, September 26, 2023, the SEC postponed its decision on the spot ETF approval of: Global X Bitcoin Trust and ARK 21Shares Bitcoin ETF. The interesting issue is that this time the SEC acted well in advance of the usual timeline, as the decision for the former was scheduled for Saturday, October 7, and for the latter on Wednesday, November 11.

On Wednesday, September 27, 2023, the SEC postponed its decision on the approval of the Ethereum spot ETFs of: ARK 21Shares Ethereum ETF and VanEck Ethereum ETF. Both were submitted to the U.S. regulator and had deadlines in mid-November at about. The SEC is moving quickly these days.

On Thursday, Sept. 28, 2023, the SEC postponed its decision on the approval of spot ETFs on Bitcoin by: Valkyrie Bitcoin Fund, Bitwise Bitcoin ETP Trust, iShares Bitcoin Trust (BlackRock), Invesco Galaxy Bitcoin ETF; missing from the list are ETFs from WisdomTree, VanEck, and Fidelity. These delay orders, as mentioned above, come much earlier than usual.

On Friday, September 29, 2023, the SEC delayed, as was suggested in the previous update paragraph, the decision on the approval of the spot ETFs on Bitcoin by: WisdomTree Bitcoin Trust and Wise Origin Bitcoin Trust (Fidelity); no news for VanEck.

On Monday, October 16, 2023, an event occurred that can be traced back to the topic covered in âPotential consequences for the crypto sectorâ. Cointelegraph, an online magazine specializing in the dissemination of news pertaining to the crypto sector, posted a tweet at 3:20 p.m. on X stating that BlackRock’s Bitcoin spot ETF (iShares) had been approved by the SEC. It turned out to be fake news. However, the price of Bitcoin did pump from about $27800 to $30300 (the arrival price of the spike changes from exchange to exchange depending on the liquidity present at the time), liquidating many short positions. The odds that such news was published either by accident or by mistake are infinitesimal.

OnMonday, October 23, 2023, the crypto industry learned that the ticker for Bitcoin’s spot EETF, which will be made available to investors by BlackRock when the SEC confirms approval, is called: âIBTCâ.

On Thursday, Nov. 9, 2023, BlackRock officially filed an application with the SEC for approval of the âiShares Ethereum Trustâ, then the spot EETF on Ethereum (ETH), the world’s second most capitalized cryptocurrency, which more or less should be approved in mid-2024, but it is too early to define precise timelines. All in all, this is good news for the crypto sector, which has now been accepted into the global financial system, as it has proven that it is not a passing phenomenon.