History

Cardano is the brainchild of Charles Hoskinson, co-founder of Ethereum, who describes it as the third generation of blockchain after Bitcoin and Ethereum.

The first generation of blockchain, which specifically includes Bitcoin, offered the ability to transfer cryptocurrencies from one wallet to another in a totally decentralized and secure manner, but it did not have an ecosystem that could offer additional services or create applications within it. The second generation of blockchain, on the other hand, like Ethereum, launched the ability to create smart contracts and decentralized applications, but it still had several problems related to scalability and interoperability.

Thus, Cardano’s goal is to create an advanced ecosystem based on smart contracts and DApps, but unlike its predecessors, Cardano aims to solve the problems of Bitcoin and Ethereum by starting from scratch and with a scientific and philosophical approach. Let’s start from the beginning, however.

Cardano began in 2015 as a research project to understand how cryptocurrencies could be improved. In fact, the development team was nothing more than a group of scientists, engineers, and mathematicians whose task was to combine the good sides of Bitcoin and Ethereum and improve them, creating ‘the perfect blockchain.’

After the conclusion of its ICO, raising as much as $62 million, the project began, and on September 29, 2017, the first phase of the project, the so-called “Byron phase,” began, which we will see in detail in the following paragraphs.

How it works

The 3 aspects on which the Cardano blockchain is based are:

- Scalability: the Cardano network is able to process a large number of transactions per second (tps), changing the limit according to the need and network traffic and implementing various techniques regarding data compression. Currently the average is about 7 tps since the network is not particularly clogged, but this limit can be increased up to 50 tps and well beyond if needed. In addition, an implementation is on the way with the Hydra project, Cardano’s layer-2, which can increase scalability through multi-sidechain systems to reach purely theoretical levels of tps in the hundreds of thousands, if not millions;

- Interoperability: one of the most frequent problems within the crypto world is definitely interoperability. It is often seen as a secondary goal to scalability or decentralization, but it remains a fundamental goal for the industry. Cardano in fact was developed to support cross-chain transfers, different types of tokens and smart contracts written with commonly used programming languages;

- Sustainability: the proof-of-stake consensus mechanism allows the blockchain to be self-sustaining, thanks in addition to the community-driven governance system that allows the treasury system, a fund created thanks to a portion of the new ADA (Cardano’s native cryptocurrency) mint, used for transactions and distributed as rewards for staking pools, to be managed by voting.

Team

The peculiarity of Cardano is probably its development team. It consists of 3 different independent teams, each with a leader, who control various aspects of the project:

- IOHK: “InputOutput Hong Kong,” founded by Charles Hoskinson and Jeremy Wood with the task of creating blockchain in a decentralized way. The particularity of this company in fact is that it consists of small teams of researchers, educators and academic partners scattered all over the world, self-sufficient and able to decide together on Cardano developments. IOHK in particular is dedicated to promoting research and academic studies related to the cryptographic and blockchain world;

- Cardano Foundation: legal custodian of the Cardano protocol and brand, the foundation is concerned with expanding blockchain adoption and partnerships. It is also a kind of council that decides together with the community what is best for Cardano;

- Emurgo: develops, supports and creates business opportunities and facilitates the integration of them within the blockchain. It has offices scattered around the world (Japan, USA, Singapore, India, Indonesia) creating a kind of network of blockchain experts and developers.

Project Phases

The phases of the project take their names from prominent figures of the 1800s:

- Byron | Foundation: the initial phase, which officially began in September 2017. The first version of Cardano involved simple exchanges of ADA, the network’s cryptocurrency. Initially, the network was centralized, supported entirely by two stake pools managed by the IOHK and Emurgo development teams. Also at this stage, the two official Cardano wallets were launched: Yoroi and Daedalus;

- Shelley| decentralization: Shelley finalized the blockchain, bringing it to be decentralized. Based on Byron’s “federal” model, staking pools became community pools and gradually grew, decentralizing the network. In order to implement this upgrade, which is quite important on a technical level, a unique hard fork was performed. In this case, in fact, the hard fork did not create a second chain post update, but kept the history of the Byron phase, thus keeping the Byron blocks on the chain, followed by a transition period and then the arrival of the Shelley blocks;

- Goguen | smart contracts: this phase introduced the development of smart contracts, the creation of DApps and custom tokens allowing the development of a true Ethereum-like ecosystem;

- Basho | scalability: this phase will focus exclusively on improving and enhancing the scalability and interoperability of the network, thus shifting development from new features to enhancing existing ones;

- Voltaire| governance: Voltaire will enable active participation in the development and improvement of the blockchain through the staking-based on-chain governance system.

Ouroboros

Ouroboros is nothing but the name given to the Delegated-Proof-of-Stake (DPoS) consensus algorithm underlying Cardano. Its special feature is that it divides blocks into epochs, successively divided into time slots.

A Slot Leader is randomly elected at each time slot and will be in charge of adding new blocks to the chain. Thus there is no ‘race’ to create the block, but it all happens randomly and you have a better chance of being chosen in proportion to the number of ADAs you hold.

Holders can delegate their ADAs within staking pools so that they have a chance to be elected while remaining offline. In fact, in many consensus algorithms, it is necessary to stay online at all times in order not to miss the opportunity to create the block.

Furthermore, to keep the network secure and avoid malicious behavior by nodes, you receive rewards based on the ADAs you possess even if you do not create new blocks, keeping a small value of rewards constant for all those who choose to keep the network active.

This Proof of Stake algorithm was the first to be found scientifically secure and accepted by the crypto community in Crypto 2017.

Ourobors has several phases related to its development, let’s see them in detail:

- Classic: implemented the foundations of the algorithm: energy efficiency of PoS, staking incentives, and randomness of Slot Leader selection. This last feature is the thing that differentiates Ouroboros from other proof-of-stake algorithms: the randomness of choice allows for far greater security than any other consensus algorithm because it disfavors the possibility of patterns and thus possible security holes;

- BFT: “Byzantine Fault Tolerance,” in fact it was the implementation that improved communication between nodes and is the phase that laid the foundation for the Shelley upgrade of the network;

- Praos: this phase implemented the system of epochs and time slots as well as a cryptographic key pair that adds an additional layer of security in block creation (which we will see in detail later);

- Genesis: this phase will implement an innovative system for the creation of sidechains. Basically, it will be possible to create new blockchains linked to a main-chain starting directly from the genesis block, and not from some “trusted checkpoints” as is the case with other side-chains already in use;

- Crypsinous: This phase will introduce a system to preserve user privacy, thus creating a potentially private blockchain. This update will not be introduced on the Cardano blockchain, but will be a possible update that other blockchains can take advantage of;

- Chronos: this latest update will allow the network to resist attacks based on node time zones, allowing it to synchronize on a time system of its own and unique to the network.

Cardano’s keys

Cardano’s keys are divided into:

- Node keys: They represent the security of the blockchain and are further divided into:

- Operator/operational keys: are a key pair (cold and hot) managed by the node operator;

- KES key pair: in order to get a node capable of producing blocks, an additional key pair, KES (Key Evolving Signature) keys, is required. These keys have the special feature of being expiring, thus allowing greater security in case of cyber attacks or theft;

- VRF keys: the Praos update of Ouroboros added these keys, called VRFs (Verifiable Random Function), thus adding an additional layer of security. In other protocols (Ouroboros classic or BFT), everyone knows who has the right to create the block in each time slot because the Slot Leader is public. After Praos, no one knows in advance who the Slot Leader will be, not even the Slot Leader himself. Once the block generation process is started, the Slot Leader who has been drawn will have to verify that he or she is himself or herself using the VRF keys.

- Address keys: represent the addresses that identify funds in the blockchain and are divided into:

- Payments key: single key pair used to generate UTXO adresses;

- Stakingkey: key pair used to generate staking rewards.

Governance

Cardano’s latest update, Voltaire, has the sole purpose of creating a completely decentralized system in every aspect of the network.

In fact, Voltaire will allow the community, that is, anyone with voting rights within the governance, to vote on: network upgrades, technology improvements, and treasury fund management.

Anyone within the Cardano community can propose an upgrade, which will then be subject to a vote. To be eligible to vote, one must have ADAs in staking.

There are 3 types of roles in voting:

- Voter: the basic role that allows one to obtain the right to vote. It is obtained by reaching a minimum value and the voter has the option to vote directly or delegate their vote;

- Experts: have the same rights as voter, but the weight of his vote increases according to the number of voters who delegate their votes to him;

- Election committee: they are chosen randomly from among the voters and will be the ones who will have the role of tellers at the end of the voting. They too can participate in voting;

Voting is based on 3 options: yes, no and abstention. During the voting period there are several proposals that are viewed and voted on.

After the voting period, the Voting committee records and verifies the votes, taking a portion of the treasury fund (about 20%) and distributes this portion among all the voters and experts.

Tokenomics of Cardano (ADA)

ADA is the native coin of Cardano’s blockchain and is required to operate in its network, particularly for everything from staking, fees, governance, and for features that will be implemented with upgrades planned for the coming months and years.

The maximum coin supply has been set at 45 billion ADA, while the total supply, which includes both coins in circulation and those in the Treasury, stands at approximately 34 billion ADA, as of the date of writing. A Cardano-specific wallet called “Daedalus” has also been launched over the years, from which “Yoroi,” a lighter, faster and easier-to-use version of the same, was developed.

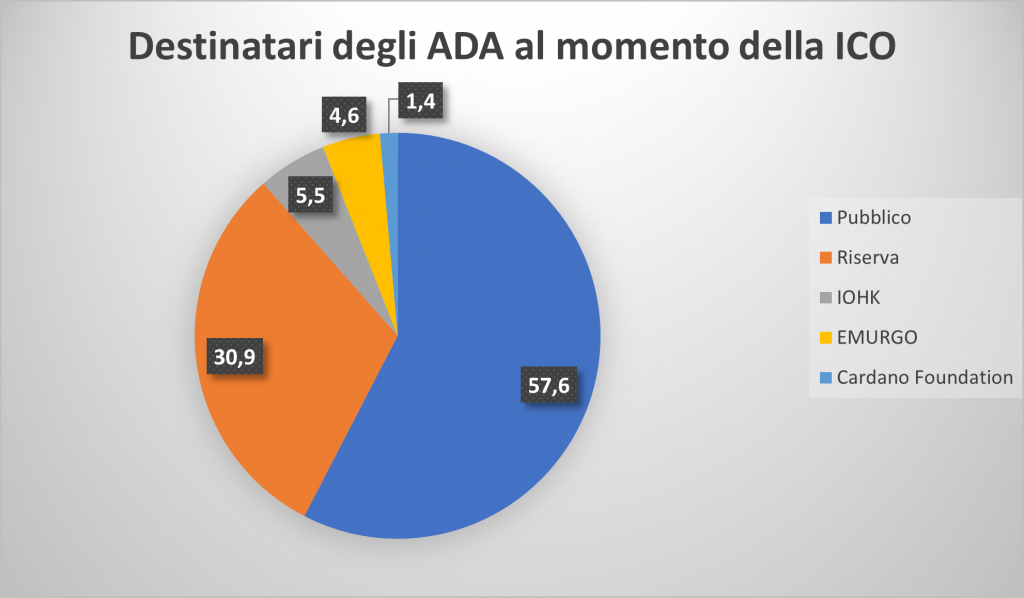

The Initial Coin Offerings

Cardano ICO took place between September 30 and December 31, 2016, and 31,112,484,646 ADAs were generated at the genesis block.

Below we list the distribution of these coins annexed by percentage:

– Public: 25.9 billion (57.6%)

– Reserve: 13.9 billion (30.9%)

– IOHK: 2.46 billion (5.5%)

– EMURGO: 2.07 billion (4.6%)

– Cardano Foundation: 640 million (1.4%)

During the ICO, Cardano’s team sought early on to pursue the principles of blockchain decentralization and coin distribution, as well as network expansion in order to reach as many people as possible.

After all, one of the cornerstone principles of crypto is “banking the unbanked.” If most coins are in the

the hands of investment funds, VCs (Venture Capitalists) or high-net-worth individuals, then it is very likely that these individuals, driven by mere speculation, will dump their assets on the market when the price of the crypto goes way up.

A team of developers must choose between attracting substantial and rapid funding or building over time a network with a large community and a blockchain that is as decentralized and distributed as possible.

At the time of writing, the holders of ADA’s maximum bid break down as follows:

- Treasury: 1.7%

- Reserve: 24.4%

- Circulating supply: 73.9%

If we wanted to draw a parallel, we know that Bitcoin is comparable to a commodity (in the sense of a financial instrument) because its coin supply cannot be controlled, manipulated or managed by any private or public entity.

If we considered only the distribution of ADAs, we could say that it is very close to the level of Bitcoin, remembering, however, that the

tokenomics, i.e., monetary policy, of ADA can be changed more easily than that of BTC.

Staking and inflation

Since Cardano is based on the Delegated Proof of Stake consensus algorithm, it is possible to staking one’s ADAs to receive a staking reward, which varies according to the performance of the “pool” the user chooses.

In recent years, the staking ratio has been roughly 70 percent, which is a fairly high figure, taking into account that the distribution of ADAs, the decentralization of the blockchain, and the size of the community that supports Cardano are remarkable.

Moreover, such a high percentage of coins put into staking can result in supply shock, i.e., extreme price fluctuations based on changes in demand.

Validators who own pools and those who delegate their ADAs for staking earn a reward each epoch, and an epoch consists of 5 days.

The rewards are composed of circulating supply expansion and transaction fees.

The “new” circulating supply comes from the Reserve, which consists of the difference between the maximum supply and the total supply of ADA. During each epoch, 0.3 percent of the Reserve is distributed as staking rewards and treasury funding.

There is an incentive to staking ADA for the medium to long term because the ADA inflationrate, i.e., the rate of supply inflation, is around 2 percent per annum (APY) and is lower than the average staking reward offered by the staking pools, from 5 percent to 6 percent APY.

Again in terms of comparison, as with Bitcoin the supply inflation of ADAs is not linear: most ADAs were released in the early years of Cardano’s life and around 2030 it is expected that it may become almost “deflationary.”

By this is meant that there will no longer be a need for demand to increase to absorb the release of new coins, because the amount of those entering circulation will be significantly reduced compared to the beginnings of the Cardano blockchain.

NFT, DeFi and Metaverse

Within the Cardano ecosystem there are already a number of projects related to the DeFi and NFT worlds, as well as several metaverses under development.

First NFT marketplace among all is probably CNFT.io, Cardano’s Opensea, which has already recorded sales in the hundreds of thousands of dollars and volumes in the millions.

The two most promising metaverses are Cornucopias (which we have already discussed in the dedicated lesson “Meta | What is metaverse and how it will be in the future”) and Pavia.

Pavia was the first metaverse to be built on Cardano and is named after the hometown of Gerolamo Cardano, the Italian scientist who inspired the name of the blockchain.

As for defi, there are dozens of dex and stablecoin-related projects, one among them “Ardana.”

Wallets

There are currently two active wallets in the Cardano ecosystem:

- Daedalus: a full-node wallet available for PCs, it is the most complete wallet, but also the heaviest in terms of GB and difficult to use because it is very technical. In fact, it is a wallet that downloads a blockchain node with it, making it inconvenient for the average user but perfect for validators;

- Yoroi: mobile and browser version of Daedalus but without the node. It allows a more immediate connection for DeFi and NFT projects.